In 2009, the average daily trading volume for WACKER stock was some 206,000 shares (Xetra) – thus below 2008’s figure of around 230,000 shares (Xetra). The number of financial analysts regularly monitoring and assessing the company increased slightly, even though the financial crisis prompted some banks to dispose of their research teams and many others to adjust staffing levels.

During the fiscal year, the analysts’ consensus price target rose substantially, reflecting the general trend. Whereas the average Q1 estimate had WACKER’s share price at €74.42 (18 estimates)1, the fair-value price target increased to €106.81 (16 estimates)1 by year-end.

On our website, we regularly report on the consensus of analysts’ expectations for the current year. Moreover, our website offers extensive information on WACKER stock. In addition to financial reports, presentations, publications and a Fact Book (viewable online or downloadable), you’ll find all our key financial-market dates, as well as contact information there. You can also view videos of our annual press conference, analysts’ conference and other events online or listen to an audio stream. www.wacker.com

| download table |

|

The Following Banks and Investment Firms Monitor and Assess WACKER | ||||

|

| ||||

| ||||

|

B. Metzler seel. Sohn & Co. |

Independent Research GmbH | |||

|

Bankhaus Lampe |

JPMorgan | |||

|

Barclays Capital |

Kepler Capital Markets | |||

|

BHF-Bank AG |

Landesbank Baden-Württemberg | |||

|

CA Cheuvreux |

Macquarie Securities | |||

|

Citigroup |

MainFirst Bank AG | |||

|

Commerzbank |

Merrill Lynch | |||

|

Credit Suisse |

Morgan Stanley | |||

|

Deutsche Bank |

Norddeutsche Landesbank Girozentrale | |||

|

DZ Bank |

Reuschel & Co. Privatbankiers | |||

|

equinet |

Sal. Oppenheim | |||

|

Exane BNP Paribas |

Soleil Securities | |||

|

fairesearch GmbH & Co. |

UBS | |||

|

Friedman, Billings, Ramsey & Co. |

UniCredit | |||

|

HSBC Trinkaus |

WestLB | |||

With the publication of our 2009 Online Annual Report, we underscore our services for analysts and investors. The new easy-to-navigate online version of the report facilitates information access – and interactive options (such as key-indicator comparisons and a toolbox) enable readers to work directly with the figures.

1 = Consensus figures from VARA Research (Q1=March 9, 2009/Q4=December 10, 2009)

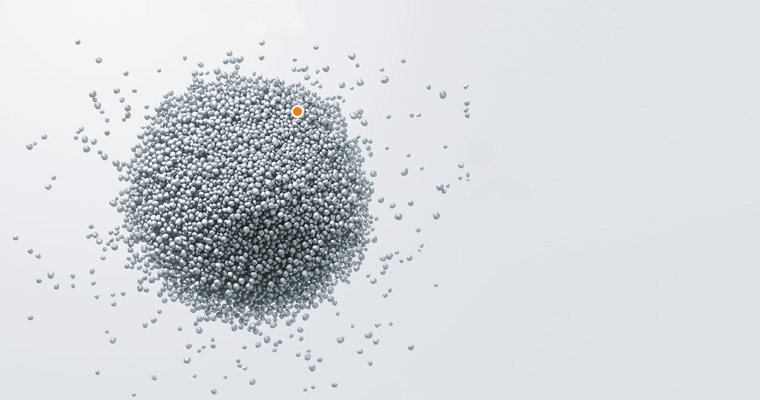

Strong Gain in Market Capitalization and MDAX/GEX Weightings (Weightings as per December 30, 2009)

The performance of WACKER stock boosted its market capitalization to €6.1 billion by year-end (total stock without treasury shares). WACKER’s MDAX market capitalization was €1.83 billion and determined exclusively according to the free float, including treasury shares. Thus, WACKER had an MDAX weighting of 3.09% – ranking tenth among the 50 companies listed there.

WACKER’s GEX weighting was 10.13%. Deutsche Börse’s GEX mid-cap index (introduced in January 2005) comprises owner-dominated companies listed on the Frankfurt Stock Exchange (Prime Standard) for no more than ten years. In 2009, WACKER ranked second in that index.