At WACKER, we focus on sustainably increasing our company’s value in the long term. This is why value-based management is an integral part of our corporate policies. Under the EAGLE acronym (Eye At Growing a Longterm Enterprise), WACKER has been consolidating value-based management groupwide since 2002. Value management and strategic planning complement each other. Consequently, we must coordinate the strategic positioning of a business entity and its contribution to boosting the company’s value. Coordination is part of annual planning and involves fundamental decisions on investments, innovation plans, new markets and a variety of other projects.

| download table |

|

Cost of Capital |

|

| ||

|

|

2009 |

2008 | ||

|

|

|

| ||

|

Riskless interest rate (%) |

3.5 |

5.0 | ||

|

Market premium (%) |

4.5 |

3.0 | ||

|

Beta coefficient |

1.5 |

1.5 | ||

|

Post-tax cost of equity (%) |

10.3 |

9.5 | ||

|

|

|

| ||

|

Tax rate (%) |

30.0 |

35.0 | ||

|

Pre-tax cost of equity (%) |

14.6 |

14.6 | ||

|

Pre-tax borrowing costs (%) |

5.0 |

5.0 | ||

|

Tax shield (30%) |

1.5 |

1.7 | ||

|

Borrowing costs after taxes (%) |

3.5 |

3.3 | ||

|

|

|

| ||

|

Share of equity capital (%) |

90.0 |

90.0 | ||

|

Share of borrowed capital (%) |

10.0 |

10.0 | ||

|

Post-tax cost of capital (%) |

9.6 |

8.9 | ||

|

Pre-tax cost of capital (%) |

13.7 |

13.7 |

WACKER’s key performance indicators to assess corporate value trends are: BVC (business value contribution), EBITDA (earnings before interest, taxes, depreciation and amortization), cash flow and ROCE (return on capital employed). The cost of capital employed is calculated as a weighted cost average of equity and debt. The various business segments are evaluated differently, depending on their specific risks. The company’s ROCE shows us whether we have employed our capital successfully. CE (capital employed) is set in relation to EBIT. If CE generates a higher interest return than the cost of capital employed, WACKER has a positive BVC. BVC is a company-specific financial indicator, in which EBIT (adjusted for potential special factors) is set in relation to CE.

ROCE fell to 0.9% in 2009. Consequently, it was below the minimum target of 14%, which corresponds to the cost of capital.

| download table |

|

ROCE |

|

| ||

|

€ million |

2009 |

2008 | ||

|

|

|

| ||

|

EBIT |

26.8 |

647.9 | ||

|

Capital employed |

2,878.4 |

2,520.6 | ||

|

ROCE (%) |

0.9 |

25.7 | ||

|

Pre-tax cost of capital (%) |

14.0 |

13.7 | ||

|

Pre-tax business value contribution |

-365.1 |

303.2 |

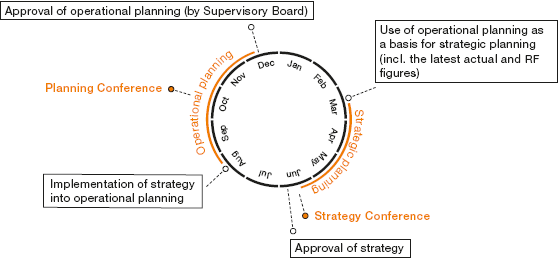

Strategic planning shows us how we can meet value-related and corporate goals. It is divided into two steps. First, our divisions identify their market and competitive positions, as well as their value-related strength. The results are integrated into a proposal for each division’s strategic positioning and planned steps. This information – including innovation and investment projects – is consolidated on a Group level. Strategic plans are then passed at a Strategy Conference.

Subsequently, strategic planning decisions are included in operational planning, which takes place in the second half of the year. The Executive and Supervisory Boards jointly approve the annual plan. Monthly comparisons of planned and actual figures show us whether we are meeting our targets. Our general planning framework is based on a four-year, medium-term plan.