In the key industries for our business, we expect economic trends to present a mixed picture in 2013.

Demand for Semiconductor Wafers to Rise in 2013

According to Gartner’s market research experts, the semiconductor-wafer market will grow in 2013. Worldwide silicon-wafer sales by surface area sold will rise 4.1 percent year on year to around 62,389 million cm ², with the 300 mm segment expected to perform even better, growing by 13.1 percent. Slight growth is also anticipated for 200 mm wafers. Conversely, 150 mm-wafer sales are likely to fall again compared with the previous year. The Gartner analysts expect semiconductor-revenues to rise by 4.3 percent globally in 2013 to around $9.8 billion. Gartner’s 2014 projections are for further increases in worldwide volumes and revenues. WACKER has scaled back production of smaller wafer diameters over the past 12 months and should benefit from further market growth for 300 mm wafers. This, however, depends on whether price pressures in this segment persist.

| Download XLS |

|

Key Customer Sectors for WACKER | ||||

|

|

|

| ||

|

Sectors |

Trends in 2012 |

Trends in 2013 | ||

|

|

|

| ||

|

Construction |

Growth |

Growth in all regions, except for Europe | ||

|

Photovoltaic |

Moderate growth |

Growth, continuing market overcapacity and ongoing consolidation | ||

|

Semiconductor |

Decline |

Moderate growth | ||

|

Energy/electrical |

Slight growth |

Growth | ||

|

Chemical |

Stagnation |

Weak growth | ||

Photovoltaic Market Remains Challenging

The photovoltaic market of 2013 continues to face production overcapacity, price pressures and uncertainty about financial incentives for renewables. These challenges could weigh on polysilicon volumes sold to our customers. The market’s development also faces another hurdle – anti-dumping investigations by the EU against Chinese solar manufacturers, and by the Chinese Ministry of Commerce against foreign polysilicon manufacturers. The consolidation process in the industry will continue.

| Download XLS |

|

Photovoltaics’ Sales Trend in 2013 | ||||||||

|

|

|

|

| |||||

|

€ million |

Installation of New |

Growth in 2013 | ||||||

|

|

2013 |

2012 |

% | |||||

|

|

|

|

| |||||

| ||||||||

|

Germany |

5,000 |

7,600 |

-34 | |||||

|

Italy |

2,000 |

4,300 |

-53 | |||||

|

Other European countries |

4,800 |

3,500 |

9 | |||||

|

USA |

3,500 |

3,000 |

17 | |||||

|

Japan |

3,000 |

2,400 |

25 | |||||

|

China |

8,000 |

5,000 |

60 | |||||

|

Other regions |

10,400 |

6,300 |

81 | |||||

|

Total |

36,700 |

32,100 |

14 | |||||

The substantial fall in prices right along the supply chain has made photovoltaics even more competitive compared with other energy sources. This trend is opening up new markets and promoting global growth in the photovoltaic-applications market. Europe, led by Germany and Italy, has been the largest market until now. Over the next two years, other countries outside Europe will grow at a faster rate. According to the EPIA (European Photovoltaic Industry Association), countries with additional growth potential include China, the USA, Japan, India and South Africa.

Based on its own research, WACKER anticipates moderate photovoltaic-market growth in 2013, with newly installed photovoltaic (PV) capacity likely to come in at between 35 and 40 gigawatts (GW).

Chemical Industry Again on Track for Slight Growth in 2013

After a somewhat weaker year in 2012, the German Chemical Industry Association (VCI) expects production and sales to edge up in 2013. Output should rise 1 percent and sales 2 percent. Exports remain the growth driver in Germany’s chemical sector. Its German and European business will barely expand. The VCI anticipates a steady rise in German chemical exports to emerging markets. The USA remains by far the biggest trading partner.

WACKER’s chemical divisions see growth opportunities primarily in BRIC countries, in other emerging economies and in the USA. Given the increasing prosperity of emerging economies, our sales will climb further in such countries as China and India, as well as in Southeast Asia. The WACKER portfolio includes many higher-quality products that are in demand among new customer groups. Additionally, WACKER POLYMERS continues to see good growth prospects for VAE dispersions in the USA, where they are replacing conventional dispersion grades. WACKER SILICONES, too, expects rising sales in the USA over the next two years.

Global Construction Industry Remains on Growth Path

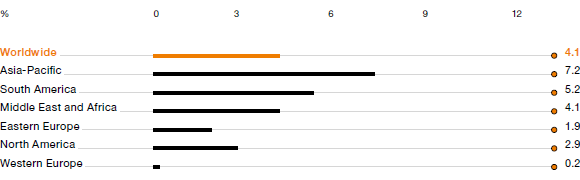

According to Global Insight’s market researchers, the construction industry will continue expanding over the next few years. Its positive performance is being somewhat dampened by Europe’s sovereign-debt crisis. Except for Europe, where only marginal growth is forecast, all other regions are expected to pick up momentum in 2013. Asia will remain a growth engine. In China, the infrastructure sector is benefiting from the economic stimulus program launched in 2012. Major infrastructure projects in Latin America are generating growth, as well. The recovery in the US real-estate market means the private housing sector, too, will expand slightly. Conversely, Global Insight expects there to be a further drop in construction activity in Western Europe in 2013. The issue of energy efficiency continues to offer WACKER very good growth prospects for the coming years.

WACKER POLYMERS anticipates higher sales to the construction industry in all regions during 2013 – the areas of continued growth being carpet coatings, interior paints and dry-mix mortars. Europe will remain a difficult market for WACKER SILICONES in 2013. We expect to post increased sales in all other regions. There are good growth opportunities not only for hybrid products made from silane-modified organic polymer building blocks, but also for the (allround) adhesives and (crystal-clear joint) sealants formulated from them, and for silicone cartridges sold under our own brand.

Regional Construction-Industry Growth in 2013

Source: Global Insight (Jan. 2013)

Electrical and Electronics Industries Optimistic

The 2013 outlook for the electrical and electronics sectors is one of confident optimism. According to the German Electrical and Electronic Manufacturers’ Association (ZVEI), market volumes could rise further in 2013. The ZVEI expects to see growth of 6 percent. There will be double-digit expansion in the BRIC countries, which remain the key driving force behind the global electrical and electronics sectors. In Germany, the electronics market is expected to grow by 1.5 percent to around €177 billion (2012: €175 billion). The expansion of electricity grids will benefit business at WACKER SILICONES. In established industrial markets, old grids are being renewed or upgraded and new grids are being constructed (for example, in Germany) for the distribution of wind power. New electricity grids in emerging economies are improving the power supply and providing better availability. WACKER is a leading player in the USA, Europe and India with its high-temperature-curing silicone rubber for long-rod insulators and its liquid silicone rubber for hollow insulators and cable fittings.

We also anticipate good growth prospects in automotive electronics, which remains a dynamic market. Demand for products exhibiting superior temperature and media resistance is rising. This is an area in which WACKER SILICONES supplies UV-initiated silicones and innovative temperature- and media-resistant potting compounds for engines. Additionally, we expect to generate growth with products for optical applications (LEDs) and screens (displays).