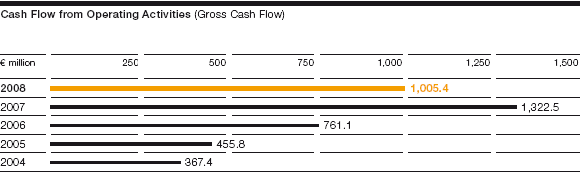

WACKER’s internal financial strength weakened somewhat in 2008. Cash flow from operating activities amounted to €1.01 billion (2007: €1.32 billion), falling 24.0%. This is due to the fact that customer prepayments for future polysilicon shipments did not match prior-year levels. Cash inflows from prepayments were €197.7 million (2007: €413.2 million). In contrast, the inflow from net income rose to €438.3 million (2007: €422.2 million). HR provisions and depreciation likewise increased. Depreciation rose €55.4 million to €407.3 million. Trade receivables positively impacted our cash inflow. This is due to our rigorous receivables management. Adjusted for exchange-rate effects, trade receivables fell €25.7 million, whereas there had been an increase of €4.0 million in 2007.

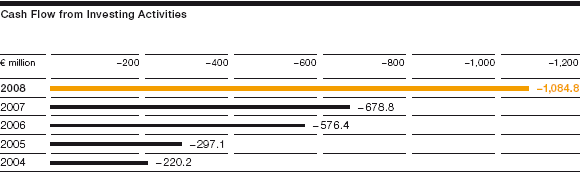

Liquidity outflows for investments in intangible assets, property, plant, equipment and financial assets rose substantially in 2008 – rising to €983.7 million (2007: €678.8 million). This is an increase of €304.9 million. Most of the funding flowed into production facilities for polysilicon, siloxane, silicon wafers and dispersible polymer powders. After deduction of the cash and cash equivalents acquired from the APP companies, €171.2 million was paid out to acquire Air Products’ stakes in our two former partner companies – Air Products Polymers (APP) and Wacker Polymer Systems (WPS). Investments in our two joint ventures with Samsung Electronics and Dow Corning amounted to €86.5 million. See further details on Segments & Regions

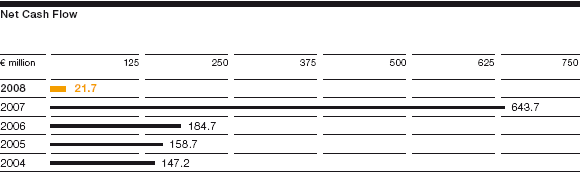

Net cash flow (the difference between cash inflow from operating activities and cash outflow due to investment activities) amounted to €21.7 million in 2008 (2007: €643.7 million) – a year-on-year decline of €622.0 million.

In fiscal 2008, cash outflow from financing activities totaled €87.7 million (2007: €318.9 million). Key items here included the distribution of dividends to shareholders (primarily to Wacker Chemie AG shareholders amounting to €149.1 million) and the buildup of financial liabilities of €59.3 million. Most of the funding went to our Chinese holdings to press ahead with the continued expansion of our operations there.