WACKER’s procurement volumes increased in 2011, due to gains in both quantities and prices. Volumes are broken down into raw materials and energy, services, materials and equipment, with a high proportion for investments. WACKER spent €3.45 billion (2010: €2.80 billion) on raw materials, other materials and services. 2011’s figure includes investment-project-related procurements of €870 million (2010: €575 million). Our procurement rate – the volumes purchased for raw materials, services and other materials in relation to sales revenue – was 70.2 percent (2010: 59 percent). In 2011, we procured some 1,300 different raw materials, and numerous technical goods and services for plant-engineering and maintenance-related purposes. Our suppliers number around 9,900 (about 8,800 in the Technical Procurement & Logistics department and around 1,100 in Raw Materials Procurement).

| download table |

|

Procurement Volumes (including Procurement for Capital Expenditures) | ||||||||||

|

€ million |

2011 |

2010 |

2009 |

2008 |

2007 | |||||

|

|

|

|

|

|

| |||||

|

Procurement volumes |

3,418 |

2,799 |

2,342 |

2,660 |

2,291 | |||||

Higher Quantities and Prices Raise Energy and Raw-Material Procurement Volumes

Procurement volumes for energy and raw materials rose in 2011. About a quarter of the increase stemmed from higher quantities and about three quarters from higher prices. We purchased increased quantities of ethylene, vinyl acetate monomer and polyvinyl alcohol. We bought less silicon metal because our Holla site has provided captive silicon-metal production since 2010. Our energy requirements climbed again with the launch of polysilicon production in Nünchritz, the additional power demand from Holla, and the expansion in Burghausen. Overall, the increase in energy and raw-material prices amounted to some €190 million. Of that amount, most was due to higher raw-material prices.

WACKER concluded new supply contracts in 2011 with terms ranging from one to three years to secure raw-material needs over the mid-term. By staggering the timing of agreements and contractual periods, and by including flexibility clauses in contracts, we are better able to mitigate possible declines in quantities and to use short-term options on the spot market.

For methanol, we concluded a new three-year agreement (2012-2014) and a new two-year agreement to 2013. We negotiated and concluded several new agreements for silicon and extended a current contract to 2015. We secured the delivery of vinyl acetate monomer (VAM) with a new supply agreement in China and multiyear contracts in the USA. Additionally, existing agreements in China and the USA were extended. For ethylene, we negotiated three new contracts to supply various locations: one new long-term contract for Burghausen and two new agreements for our Calvert City site in the USA. Additionally, a mid-term agreement until 2018 was reached for Nanjing, China.

In energy purchasing, we have, for the first time, concluded several favorable long-term agreements running until 2020 for the supply of electricity in Germany. We have also secured attractively-priced terms on the open market for gas supplies to the Nünchritz site. For the Holla site in Norway, we have negotiated a long-term electricity contract.

As regards future polysilicon production in Tennessee (USA), negotiations and qualification processes for sourcing with raw materials and energy are currently underway to ensure the site’s long-term supplies at competitive prices.

Technical Procurement & Logistics

WACKER’s Technical Procurement & Logistics department posted an increase in order volume, primarily due to our strong investing activities. The market for technical materials was generally characterized by high demand, with some long delivery times. Materials, equipment and packaging that depend on raw materials saw additional price increases, as did certain services. WACKER – including Siltronic – issued a total of 271,000 orders. At Technical Procurement & Logistics, 10 percent of our suppliers cover 80 percent of our procurement volume.

In 2011, we concluded major framework contracts not only in IT and logistics, but also in engineering (to support our global investment projects) and in the electrical segment (to handle “C” category procurement articles – i.e. ones not allocated to the categories of production materials or raw materials).

Our Project Procurement unit handled nine projects at various stages of planning in 2011. The two largest were the polysilicon expansion projects in Nünchritz (Germany) and Tennessee (USA). We continue to systematically review supplier risks on a worldwide scale, using analyses from rating agencies, supplier assessments and, increasingly, direct contact with our partners. We ourselves conducted 510 supplier assessments in 2011. In future assessments, we will take a closer look at sustainability, occupational safety and processing using electronic order transactions. We took a major step forward in 2011 with respect to qualifying suppliers. Orders of €25,000/US$50,000 and above are released uniformly worldwide via an electronic approval process.

Another Rise in Electronic Procurement Transactions

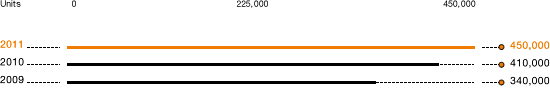

The number of electronic procurement transactions rose markedly. Out of a total of around 600,000 orders, some 450,000 (75 percent) were processed electronically, compared with 410,000 in 2010. Procurement via e-catalogs also rose, with the number of suppliers using them climbing by 37 to 160. There are over 1.6 million e-catalog articles, and over 180,000 orders were placed using this system (2010: 160,000).

Direct Contact with Our Suppliers

Direct contact with our suppliers is an important building block for successful procurement management. About 200 companies participated in our 16th Supplier Day in Burghausen. The following German suppliers received commendations in the Technical Services category: Leoni (Kerpen), Kraftanlagen München (Munich) and Ruperti Werkstätten. Siltronic presented its Supplier Award to Nitta Haas, a Japanese polishing pad manufacturer. We renamed the event previously known in the German logistics industry as Shipping Day to “Logistics Day.” The shippers OOCL Logistics and Leo Prünster, together with the cartridge manufacturer Fischbach, won an award at this Burghausen event. WACKER values its long-term collaboration with suppliers, and at the same time, focuses on reducing its dependency on individual ones. In Germany, which remains our largest procurement market, we cooperate with some 6,600 suppliers. The average length of our business relationship (Technical Procurement & Logistics) is ten years.

Shipping Volume Rises

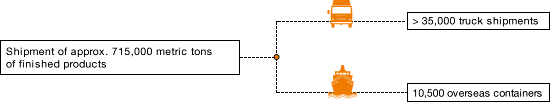

Shipping volume increased again year on year, especially in the first half of 2011. Our Burghausen logistics hub shipped some 715,000 metric tons (2010: 700,000 metric tons) of finished products to customers. That volume involved about 35,000 truck loads and 10,500 overseas containers.

Planning Approval for Public Freight Terminal Received

WACKER continues to work on adjusting its logistics structures to the increasing business volume. At Burghausen, planning approval for a public freight terminal was received. Additionally, there are plans for a new freight gate at our site, which is intended to facilitate incoming and outgoing freight, allow a direct connection to the public terminal, and speed up throughput times at the plant.

At our Nünchritz plant, we revised our site-specific logistics policy with the commissioning of polysilicon expansion stage 9. We investigated the overall flow of goods and materials in procurement logistics, in in-plant transport and in distribution. We drew up a master plan to support logistics at Nünchritz in the coming years.