We are making plans for the future on the assumption that the global economy will grow in 2012. The BRIC countries and other emerging markets will be the main growth drivers.

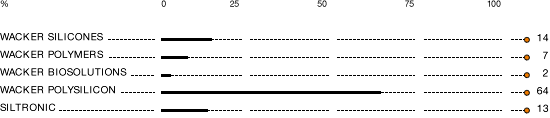

We expect that WACKER will continue to grow organically. Investments will remain high. Our investment plans are geared to investing in major markets, to safeguarding our market share, and to reinforcing our competitive edge through innovative technical processes. The emphasis of our investment spending over the next two years will be on expanding polysilicon production operations at WACKER POLYSILICON. Our key project here is the construction of a new polysilicon facility in the US State of Tennessee. Due to this project, a large portion of our capital spending during 2012 and 2013 is in the USA.

We are building two new production plants at Nanjing (China) for WACKER POLYMERS and WACKER BIOSOLUTIONS. Our existing facilities for producing vinyl acetate-ethylene copolymers for dispersions are being expanded by a new reactor with an annual output of 60,000 metric tons. It will double WACKER POLYMERS’ capacity for VAE dispersions at Nanjing to approx. 120,000 metric tons per year. WACKER BIOSOLUTIONS is also building a new plant to produce polyvinyl acetate (PVAc) solid resins, with an annual capacity of 20,000 metric tons. This move will strengthen our position as the world’s leading manufacturer of polymers for dispersions and gumbase.

At WACKER SILICONES, we are investing in facilities for manufacturing downstream products, for example. Investments at Siltronic are highly diversified. One important project involves increasing capacity for 300 mm wafers at our joint venture with Samsung Electronics in Singapore.

Capital expenditures are expected to reach approx. €1 billion in 2012. A similar volume is planned for 2013. The depreciation amount will exceed €500 million in 2012 and reach some €700 million in 2013.

Future Products and Services

We see further growth potential over the next two years in the replacement of styrene-butadiene polymer with WACKER VAE dispersions and in the development of new products. In our view, the move to the more cost-effective VAE dispersion alternatives will continue and extend from the paper and carpets industry to the field of coatings.

At WACKER SILICONES, we aim to promote products made from thermoplastic silicone elastomers. The products can change their crosslinked state under the effect of heat by the use of conventional technologies without losing the typical properties of silicone. We see market potential especially in the photovoltaic, medical and film industries.

Research and Development

The emphasis of our R&D work will remain on key strategic projects. WACKER is planning to use 25 percent (2011: 21 percent) of its R&D budget for such projects in 2012. The R&D budget is set to rise by some 4 percent in 2012 compared with the previous year (2011: €172.9 million). Our R&D priorities remain the highly promising fields of energy, catalysis, biotechnology, construction applications and semiconductors. We are devoting particular attention to energy storage and renewable energy generation.

Production

WACKER will bring new production capacity on stream over the next two years. Burghausen’s polysilicon capacity will increase by 5,000 metric tons in 2012. The Poly 11 expansion stage at Charleston (Tennessee, USA) will be completed in late 2013 with a nominal capacity of 18,000 metric tons. 2013 will also see the two Nanjing-based production facilities come on stream for WACKER POLYMERS (VAE dispersions) and WACKER BIOSOLUTIONS (PVAc solid resins).

| download table |

|

Production Facility Start-Ups in 2012–2013 | ||||

|

Site |

Project |

Start-Up | ||

|

|

|

| ||

|

Burghausen |

Polysilicon production |

2012 | ||

|

Burghausen |

Lab buildings |

2012 | ||

|

Ulsan |

VAE dispersions |

2012 | ||

|

Charleston, Tennessee |

Poly 11 expansion stage |

2013 | ||

|

Nanjing |

Solid resins |

2013 | ||

|

Nanjing |

VAE dispersions |

2013 | ||

As announced in December 2011, Siltronic is to close its production plant for 200 mm silicon wafers at Hikari (Japan) in mid-2012. WACKER will cease making its own acetic acid at Burghausen in 2012 because we can buy in the amounts more economically and with a similar level of supply security.

Under the groupwide “Wacker Operating System” (WOS) program and its component projects, we will reassess all the main productivity levers (raw-material and energy efficiency, capacities, and labor productivity). We will place the emphasis on key projects that have a high economic impact on costs and benefits.

Due to the polysilicon project in Tennessee, we spur on the process of establishing regional planning teams in the USA that collaborate closely with WACKER’s engineering units in Germany.

Technical spending will edge up in 2012.

Procurement and Logistics

Energy and raw-material procurement has an important bearing on WACKER’s profitability. In our case, energy and raw-material costs account for over one-third of the cost of goods sold. We assume that the prices of our main raw materials will, on the whole, stop rising in 2012, remaining instead at their current level. Prices for vinyl acetate are tightly linked to the oil price. The price of methanol remains at the high prior-year level. We foresee a slight drop in silicon-metal prices in 2012. As for energy (electricity, gas), we expect prices in 2012 to remain broadly stable at 2011’s levels. We do not anticipate any supply-security problems or disruptions to raw materials and energy in 2012. Our volume requirements for silicon, our most important raw material, have largely been covered for 2012. Ethylene, methanol and vinyl acetate monomer needs have also been contractually secured.

On the energy front, we have, for the first time, concluded several favorable long-term agreements running until 2020 for the supply of electricity in Germany. We have also secured attractively-priced terms on the open market for gas supplies to the Nünchritz site. For the Holla site in Norway, we have negotiated a long-term electricity contract.

When negotiating new contracts, we try to shift away from conventional, fixed annual contracts with rigid price structures. Instead, we focus more on market-based pricing formulas and on contractual escalator clauses pertaining to purchase quantities. As a result, we can respond better, and in either direction, to strong market fluctuations. For silicon metal, we want to conclude initial contracts with some new suppliers that we have identified. It remains an important goal for the next two years to achieve a greater global spread in WACKER’s portfolio of raw-material suppliers.

In Technical Procurement, WACKER’s task for 2012 is to qualify additional US suppliers for roles in the construction and subsequent operation of the polysilicon facility in Tennessee. In parallel, we are working to create a regional procurement organization for the USA once the polysilicon plant is ready. For smaller and mid-sized projects, especially in China, we will make even greater use of local suppliers – and develop and set up new supplier relationships. To further expand our procurement relationships internationally, we are also looking for additional regional sources and suppliers that WACKER can use for certain goods or services all over the world. In order to handle our procurement processes more effectively, we will introduce new SAP modules in 2012 and extend the CONTRACT software, which records all supplier agreements and archives them in a single system.

With regard to Logistics, the main task over the next two years is to secure the supply and distribution logistics for our polysilicon project in Tennessee. This includes establishing freight-transport chains connecting various suppliers from the USA and Europe to the new site in Charleston. The logistics masterplans for other WACKER sites will also be updated, and essential measures initiated and realized.

Sales and Marketing

Our e-business activities, which previously came under the umbrella of WACKER SILICONES, have been reassigned to our Sales & Distribution corporate department, effective January 1, 2012. This brings together the various sales channels under one roof. We will enhance and expand our distribution network.

Employees

In Japan, WACKER is to close the Hikari site of its Siltronic subsidiary in mid-2012. The measure will involve around 500 layoffs. Despite Hikari’s closure, the Group’s total workforce will rise to around 17,000 in 2012. This increase in employee numbers is mainly due to the construction of the polysilicon site in Tennessee and the full commissioning of the polysilicon facility at Nünchritz. We expect the employee total to rise in every region over the next two years – in line with the market trend, but at a slower rate than volume growth.

We are keeping the number of vocational training places at a high level. The need to attract fresh talent to WACKER remains a priority. As part of our employer brand project, we will define target groups among graduates and tailor our communications and advertising to our new employer profile. WACKER will continue its efforts to significantly increase the proportion of women in management positions at the company over the next few years.

Sustainability

Alongside its production sites, WACKER aims to include all its sales subsidiaries in its groupwide accreditation process in 2012. In the same year, our production sites in Holla (Norway) and Jincheon (South Korea) will join the Group’s integrated management system. As part of the process for obtaining a groupwide OHSAS certificate for occupational health and safety, we will embark on accreditation of our German sites to this standard in 2012. Our aim is to achieve groupwide OHSAS certification by 2015.

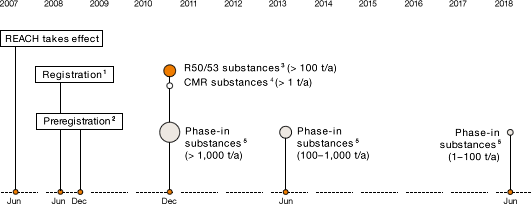

1 New substances > 1 metric ton / year

2 Phase-in substances > 1 metric ton/year

3 R50/53: “highly toxic to aquatic organisms” and “may have long-term harmful effects in bodies of water”

4 Carcinogenic, mutagenic, toxic to reproduction

5 Phase-in substances: predominantly old substances listed on the EINECS inventory (European Inventory of Existing Commercial Chemical Substances on the market before 1981)

REACH will be a major issue for us over the next ten years. By June 2013, we aim to have sent the European Chemicals Agency (ECHA) 67 dossiers on substances manufactured in quantities of between 100 and 1,000 metric tons annually. We are currently preparing about 190 more substance dossiers for the third stage of REACH, which runs until mid-2018.

In 2011, we conducted the first survey of our indirect greenhouse gas emissions from bought-in energy (as per Greenhouse Gas Protocol Scope 2). In the medium term, we also intend to measure Scope 3 emissions as per the Greenhouse Gas Protocol. These include all emissions generated along the supply chain (e.g. by suppliers or through waste disposal and the transportation of products).

Following the completion of the “ANSIKO 2010” plant safety project in 2011, we will, as a precaution, start conducting a groupwide safety examination of machinery with high risk potential in 2012. The project, going by the name of “ANSIKO 2012,” should be finished in 2013.

By 2015, we aim to have reduced our accident rate (the number of workplace accidents per million hours worked) to below 2.0, roughly halving it compared to 2010.

In 2013, WACKER will publish its Sustainability Report for 2011 and 2012.

Expected Earnings Performance

The main assumptions underlying WACKER’s plans relate to raw-material and energy costs, to personnel costs and to exchange rates. For 2012, we are planning on an exchange rate of US$1.35 to €1.

Group Sales Expected to Rise in 2012

WACKER’s target in 2012 is to generate some €5 billion in sales revenue. This is contingent on the fact that the photovoltaic market continues to grow, that semiconductor-sector demand picks up during the second half of 2012, and that the sovereign-debt crisis does not lead to a prolonged recession. Economic uncertainties mean the actual performance of the WACKER Group and its divisions could depart from our assumptions, either positively or negatively. From today’s viewpoint, our divisions should post higher sales revenues – apart from SILTRONIC and WACKER POLYSILICON. Sales volumes will be the main growth driver. We expect sales revenues to increase most in Asia. In 2013, sales-revenue growth is set to continue – provided the global economy continues to expand as forecast by the economic research institutes, and provided there are no unforeseeable slumps in the regions and sectors that are crucial to WACKER’s sales.

| download table |

|

Outlook for 2012 | ||||

|

€ million |

2012 |

2011 | ||

|

|

|

| ||

|

Sales |

Approx. 5,000 |

4,909.7 | ||

|

Below prior-year level |

1,104.2 | |||

|

Investments (incl. financial assets) |

Approx. 1,000 |

981.2 | ||

We anticipate that EBITDA for 2012 will clearly fall short of the previous year’s level. That will be mainly due to the lower prices obtained from our photovoltaic customers for polysilicon deliveries. As for Group net income, we expect to remain in positive territory. This income, however, will be lower due to higher depreciation and amortization.

Divisional Performance

At WACKER SILICONES, we anticipate slightly higher sales revenues amid increased price pressure in 2012, though without raw-material costs easing significantly. Growth will be generated mainly in Asia, where rising prosperity is prompting higher per-capita consumption of silicone products. Additionally, ever more stringent quality demands are accelerating the process of substituting simple products by value-added products that incorporate silicones. One of the priorities of our wider strategy is to increase our business for specialty products. 2012 will see WACKER SILICONES broaden its product range for the medical sector, which promises good medium-term growth potential.

Despite overcapacity for VAE dispersions and more competitors for dispersible polymer powders in Asia, we believe that WACKER POLYMERS’ prospects of volume and price growth in 2012 are good, and that its capacity utilization will be high. We aim to increase profitability by improving productivity and starting up new production facilities swiftly. Earnings growth is likely to be held back somewhat by continuously high energy and raw-material costs. Regarding dispersions business, we expect the substitution of styrene butadiene with VAE dispersions in the paper and carpet industry to translate into increased sales, especially in the USA. We will continue to pursue market strategies tailored to individual regions in order to maximize exploitation of growth potentials. The construction sector will experience mixed fortunes, depending on the country. While markets in Asia and South America are growing, they remain flat in advanced economies.

At WACKER BIOSOLUTIONS, too, we expect 2012’s sales revenue to rise. We aim to build on our position as market leader for PVAc solid resins for gumbase. There are good growth prospects in the food industry. We believe the key to sales-volume growth in that sector is the development of innovative products. We will be releasing extra R&D funding for this purpose over the coming years.

2012 promises to be challenging for WACKER POLYSILICON. Polysilicon prices will not rise and the consolidation process will continue. Inventory levels will have been adjusted by mid-year. Thereafter, demand should return to normal. Short-term demand, however, will be influenced by how the basic conditions underlying solar-energy subsidization develop. Many countries are considering measures to slow down the installation of new PV modules. Nonetheless, we are optimistic about the outlook for photovoltaics – as an important energy source of the future. The marked downturn in prices for polysilicon, wafers, cells and modules makes photovoltaics more competitive. The levelized cost of electricity from photovoltaic systems will be on a par with on-shore wind power by as early as 2013. This trend will facilitate access to new markets and promote global growth in the market for photovoltaic applications. Overall, as the cost and quality leader, we expect to emerge from this consolidation process with renewed strength. We anticipate that sales revenues for 2012 will be slightly down on the previous year. 2012 will see us completing the start-up of the Poly 9 expansion stage at Nünchritz. Our production capacity in Germany will then be around 52,000 metric tons per year.

We expect the semiconductor market to continue growing. Computers, cellphones and consumer electronics will continue to drive demand for semiconductors. Siltronic’s sales revenues should edge up in 2012. In terms of wafer diameters, we foresee business increasing for 300 mm wafers and remaining stable for 200 mm wafers. Business for the smaller wafer diameters is likely to retreat in the future. We are continuing our strategy of lead sites, where we concentrate the production of individual wafer diameters. With the closure of Hikari, we will transfer this plant’s 200 mm wafer volumes to Singapore and Portland (USA).

Expected Liquidity and Financial Performance

WACKER entered 2012 in a positive net cash position. Over the past few years, we received advance payments from our polysilicon customers. Now, our deliveries to these customers are taking place. This will lower our liquidity.

The net cash flow will be considerably negative mainly as a result of our high capital expenditures. The planned positive net income will continue to cause equity to increase.

Future Dividends

WACKER’s policy on dividends is generally oriented toward distributing at least 25 percent of net income to shareholders, assuming the business situation allows this and the committees responsible agree.

Financing

In 2012, we will adhere to our conservative financial policy. In doing so, we focus on a strong financial profile with a robust capital structure and healthy maturities for our debt. We have already laid the groundwork for medium-term Group financing over the last few years. As of December 31, 2011, WACKER had some €1.18 billion in used and unused credit lines. In February 2012, we successfully placed four promissory notes for a total of €300 million on the capital market.