The Journey into the Future

Shanghai, China: we have been active in the Chinese market for 20 years. In moving into its new Shanghai HQ, which also consolidates the local R & D activities, WACKER now has a home in China at last. The future priority is to penetrate the market even deeper – for example in the construction industry.

The Pioneering Years Are Over

When Lars Nordblom returned to Shanghai on behalf of WACKER in 2012, the first thing he noticed was that the construction cranes had gone. The Swede had already worked in Shanghai from 2002 to 2005. At that time, the city was just one huge building site, he remembers. But is the construction boom over now? No. It has just moved on to other mega-cities in this huge country.

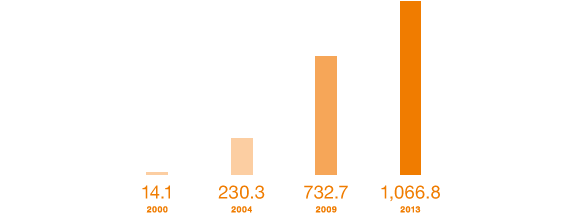

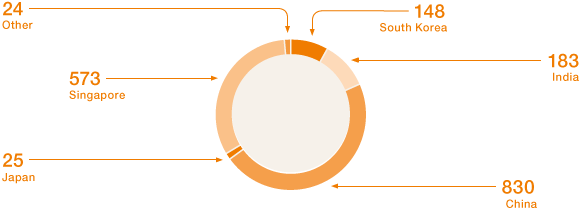

On Lars Nordblom’s second stay in China, something else had changed, too – the competition. In the dispersible polymer powders business, which he heads, WACKER is still the clear market leader, but instead of five competitors, there are now over 90. A number of domestic manufacturers have grabbed market share from the multinationals. “Competition is as tough as it gets,” says Nordblom. The pioneering years, when the company just grew and grew, are a thing of the past. WACKER now makes a fifth of its corporate sales in mainland China and Taiwan. In 2013, that totaled € 1.07 billion. After starting business in China 20 years ago by opening two offices, WACKER invested € 500 million in modern production facilities, sales, administration and later in R&D.

Outgrowing the Competition

Now it is a matter of carefully considering which market segments hold the most potential for WACKER to achieve more and which applications have the brightest future. The magic word is differentiation. With products tailored to the Chinese market, such as the less expensive price segment in construction, and with new customers and new sales channels, WACKER Greater China intends to outgrow the competition in the coming years, too.

For an insight into the Chinese construction industry, it’s worth paying a visit to Raymond Zhou’s small, glass-walled office. The marketing expert surveyed 1,400 Chinese mortar producers about their business and practices. The study only confirmed what Zhou and his colleagues had already guessed: “We can’t ignore inexpensive alternative products.” WACKER is the market leader in high-quality dispersible polymer powders, with a market share of over 40 percent says Zhou. Impressive though that may be, he’s sure WACKER can do better in the lower price segment, where the Group’s share is only just over 10 percent. The market in this area will grow much more strongly in the next few years, says Zhou.

Construction Has Moved to the Provinces

Zhou’s study also explains why his colleague Lars Nordblom didn’t see construction cranes any longer when he returned to Shanghai. The government is putting a brake on growth in mega-cities such as Shanghai, Beijing and Guangzhou. Instead, construction work is moving to the provinces. Year after year, 15 million people are moving from the countryside into cities, for example to Changshu or Shantou – mega-cities that are unknown outside China. Here, an attractive price is more important than outstanding quality. “We are building for the next 20 to 30 years, not for eternity,” says Raymond Zhou.

70-Percent Growth

Zhou’s colleagues in product development respond ed quickly to his market study. The first dispersible polymer powder specifically for this price segment was launched in 2012. “That is excellent quality for the price,” says Nordblom. In 2013, as a result, WACKER sold 70 percent more dispersible polymer powder in this market sector than in the previous year. The success was so great that further inexpensive products are under development.

Since price and availability in remote areas are crucial in this segment, products are sold via distributors. In addition, Zhou wants to sell the products in home-improvement stores and over the powerful online portal Taobao. “We want to get closer to local customers,” he says. By 2018, WACKER’s market share is expected to have risen to over 30 percent.

“Nobody Will Wait for Us”

In the long term, however, the lower price segment will disappear, Lars Nordblom believes. “Now, when we go to restaurants where we used to meet other non-Chinese colleagues, there are almost only Chinese there,” he says. Not only the super rich, but also the middle classes are doing well. “People are becoming aware of quality of life and appreciate fine things,” he says. “China will continue to develop in the way we have already seen in many other countries.” His colleague Raymond Zhou adds: “Nobody will wait for us. That is why we need a clear strategy.”

Pent-Up Demand

First and foremost, there is a product that is unimpressive to look at, namely tile adhesive. However, when Raymond Zhou reports that nine billion square meters of tiles are produced in China each year, mainly for Chinese floors and walls, the issue of tile adhesives looks much more attractive. Until recently, tile layers used sand, cement and some cheap glue to bond their tiles to the wall. Imported tile adhesive was far too expensive for them, says Zhou. Thus, only one in twenty binders was polymer-modified. So there is a fair amount of ground to gain. With ever larger tiles, narrow joints and the preferred porcelain stoneware with a very smooth backside, polymer binders are indispensable. In addition, increasing labor costs mean that working hours also play a role. “It’s no longer economical to hold the tile pressed onto the wall for a quarter of an hour until it sticks,” says Lars Nordblom. He therefore reckons on annual growth of 15 percent over the next years for VINNAPAS® in tile applications.

Construction quality is increasing and not only for tiles. Lucy Lu, business director for VAE dispersions, sees standards becoming higher in other areas, too. For example in the waterproofing of basements and wet areas. “There used to be a lot of water damage, damp walls and mold in apartments,” she explains. Waterproofing membranes are therefore being increasingly installed. WACKER has been able to triple sales of VAE dispersions in the last four years. VINNAPAS® dispersions are gaining in popularity, particularly among local manufacturers of sealing slurries.

With products tailored to the Chinese market – such as the less expensive price segment in construction – and with new customers and new sales channels, WACKER Greater China intends to outgrow the competition in the coming years, too.

Expanding Production in Nanjing

In 2013, WACKER doubled its production capacity for polymer dispersions from 60,000 to 120,000 metric tons in Nanjing. And in 2014, capacity for dispersible polymer powders is also planned to double from 30,000 to 60,000 metric tons. This will make the plant complex in Nanjing the largest of its kind in China.

WACKER is already the clear market leader in China for binders for exterior insulation and finish systems (ETICS/EIFS). This is by no means a niche market. Thermal insulation is indispensable in the north of the country. Energy saving is also becoming an important issue in other regions, too. The Shanghai lab has designed products tailored to the market. In addition, in recent years, WACKER employees have initiated pilot projects, trained craftsmen to use ETICS/EIFS systems, and become actively involved in standards and laws for low-energy construction techniques. “The People’s Congress has just raised China’s energy-saving goals,” adds Lars Nordblom.

He is counting on energy efficiency and environmentally friendly construction materials playing an ever greater role in China. People are concerned about smog and environmental scandals, says Nordblom. In a city like Shanghai, energy costs are also exorbitant, as poorly insulated apartments of 24 million residents are heated by air-conditioning systems or electric radiators in the cold winters.

Well Established

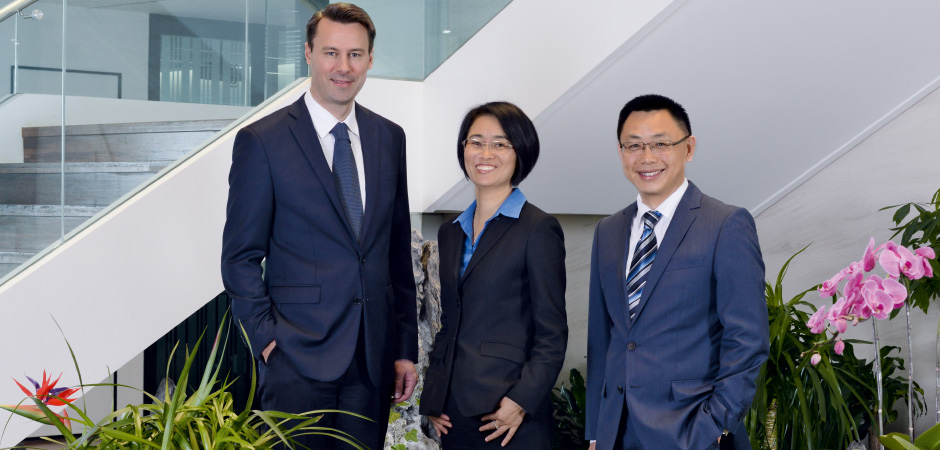

WACKER’s new Chinese headquarters shows the way to the future. The office building with its shiny facade is a low-energy structure. With over 10,000 square meters on six stories, WACKER has consolidated not only marketing, sales and administration offices, but also numerous research and test labs under one roof. Paul Lindblad, president of WACKER Greater China, stands proudly in his office and says: “The new HQ not only saves energy. It also creates a good team atmosphere, brings us together and makes it easier for all of us to work together.”

Paul Lindblad sees the HQ as a symbol that WACKER is now really established in China. That is clear even from the location of the new HQ. “The old office was just a stone’s throw from Pudong International Airport. Now we are close to the domestic airport and the railway station, where the high-speed trains start out,” he says. “As a result, we can easily reach production sites and customers throughout China.” Lindblad wants to make the company even more locally based. Of the 870 employees, 844 are already Chinese. The American would consider it only logical if his eventual successor also came from China.