The global economy continued to grow during the first half of 2011. Sentiment deteriorated considerably in the second half of the year. Demand declined in important customer sectors and the economic climate cooled substantially. Leading economic research institutes consequently lowered their growth forecasts for 2011. The significant weakening of the economy was due to the continuing debt crisis in the EU, the weakness of the American economy, China’s battle against high inflation, and structural risks in the banking sector.

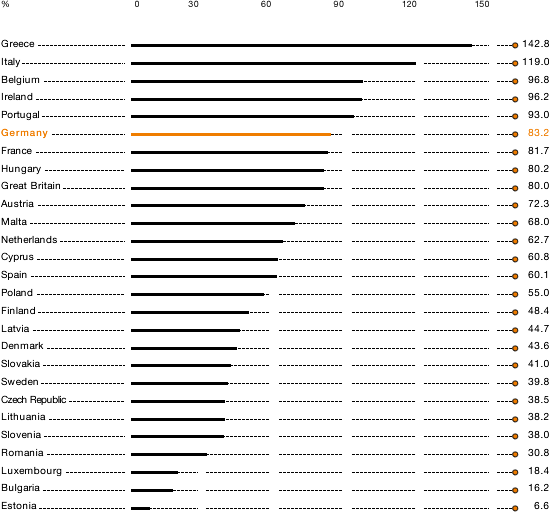

1 When different countries’ sovereign debt is compared, it is necessary to bear in mind that national economies vary in size. Total debt is consequently not expressed in absolute monetary terms, but in relation to gross domestic product (GDP). In accordance with Maastricht criteria for the European Monetary Union, total debt is not supposed to exceed 60 percent of GDP. Source: www.staatsverschuldung.de/ausland.htm (German-language link only)

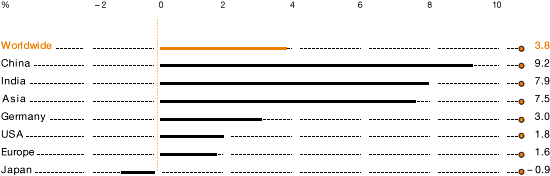

According to International Monetary Fund (IMF) estimates, the global economy grew 3.8 percent in 2011 (2010: 5.1 percent). The IMF had originally expected economic growth of 4.3 percent.

Sources – worldwide: IMF; USA: IMF; Asia: ADB; China: Chinese National Bureau of Statistics; India: ADB; Japan: IMF; Europe: IMF; Germany: Federal Statistics Office

(Dec. 2011)

Asia Remains a Growth Driver

Growth in Asia was stable and at a high level in 2011. The Asian Development Bank (ADB) expects economic expansion of 7.5 percent (2010: 9.0 percent). The two most important economies, China and India, again showed significant growth. According to the Chinese National Bureau of Statistics, China’s economy grew 9.2 percent (2010: 10.3 percent). To get a grip on high inflation, the People’s Bank of China raised its base rate several times, resulting in somewhat slower growth. In India, gross domestic product climbed by 7.9 percent (2010: 8.5 percent) according to the ADB. The Japanese economy suffered greatly from the earthquake and tsunami catastrophe. According to the IMF, Japan had to cope with a significant decline in GDP of -0.9 percent in 2011 (2010: 4.0 percent).

US Economy Remains Problematic

The anticipated upturn of the US economy failed to materialize in 2011. According to the IMF, GDP rose by 1.8 percent (2010: 3.0 percent). Private consumption could not be stimulated in spite of the US Federal Reserve Bank’s zero interest rate policy. High unemployment, the weak real estate market, low consumer confidence and the negative trade balance slowed the American economy.

Eurozone Gripped by Debt Crisis

While GDP in the eurozone grew moderately, growth was held back by the debt crisis in some European countries (such as Greece, Portugal, Ireland, Spain and Italy) and by the difficult political negotiations on solutions. According to IMF calculations, the GDP of eurozone countries rose 1.6 percent (2010: 1.8 percent).

German Economic Growth Stronger than Other EU Countries

As in 2010, the German economy grew more strongly than the other EU members in 2011. Germany thus reinforced its role as Europe’s leading industrial nation. Exports were the primary driver for this positive development. Low unemployment and a high employment level produced additional tax revenues that reduced the debt burden. Data issued by the German Federal Statistics Office show that GDP increased by 3.0 percent (2010: 3.6 percent).