Our financial management’s main goal is to maintain WACKER’s financial strength. The focal task is to sufficiently cover the financial needs of our operational business and investment projects. Financial management at the Group is centrally organized. It handles cash management and financing, as well as hedging against currency and interest-rate risks. A groupwide financial regulation sets out tasks and responsibilities. As part of liquidity management, we continuously monitor payment flows from operations and financial business. WACKER covers its resultant liquidity needs via suitable instruments, such as intra-Group financing through borrowings, or through external loans from local banks. We receive the necessary outside funding amounts via contractually-agreed credit lines in various currencies and with differing terms. We invest liquidity surpluses on the money and capital markets with an optimum risk/return rate.

In addition to the above-mentioned financing instruments, WACKER expects to be able to tap the bond markets and other instruments, if necessary. Our aim is to maintain our corporate financial structures so that the Group’s credit rating remains – at a minimum – in the investment-grade range.

WACKER’s key liquidity source is the operations of its Group companies and the resultant incoming payments. As part of our cash-management systems, liquidity surpluses at individual Group companies are used to cover the financing needs of other Group companies. Centralized in-house financial settlements reduce external-borrowing amounts and interest costs.

Financial Analysis

As per December 31, 2011, financial liabilities amounted to €777.9 million, up €244.5 million on 2010. The rise was mainly due to our accessing the second €200 million installment of our long-term investment loan from the European Investment Bank (EIB) to fund Nünchritz’s Poly 9 expansion stage. We have also drawn on existing long-term credit facilities in China to finance ongoing investment projects there.

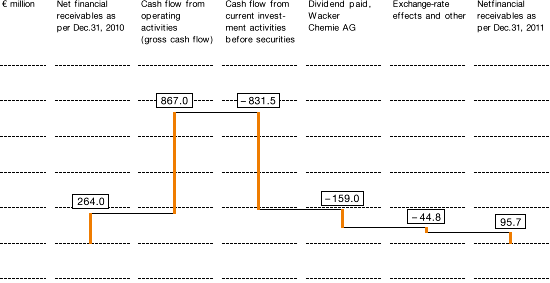

WACKER defines net financial liabilities – a key indicator – as the balance of gross financial debt (obligations to banks, including finance-lease obligations) and existing noncurrent and current liquidity, consisting of securities, cash and cash equivalents. Net financial liabilities or receivables provide insights into the Group’s liquidity position. WACKER’s liquidity situation remains good. As per the reporting date, we had net financial receivables totaling €95.7 million. In 2010, WACKER had reported net financial receivables of €264.0 million.

Aside from the financial liabilities disclosed in the report on net assets, WACKER has at its disposal sufficient unused credit lines of over one year totaling some €720 million as per the reporting date. Thus, we have enough financial leeway to secure the Group’s continued growth. The Group does not use any off-balance-sheet financing components.