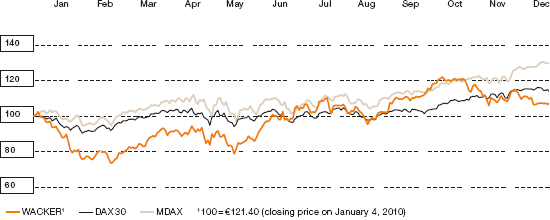

As the year began, the overriding outlook was still distinctly pessimistic. The major source of concern was the euro’s stability. Additionally, there were negative forecasts for two of WACKER’s major customer sectors. Cutbacks in German feed-in tariffs led to doubts about the financial viability of photovoltaic-industry projects, and uncertainties surrounded demand for electronic products. In the first two months of 2010, these factors put pressure on WACKER’s share price, which hit a low of €87.47 in late February.

At its annual press conference in March, WACKER announced its initial earnings targets for 2010 and issued a more optimistic outlook for subsequent quarters. WACKER’s share-price uptrend was supported by accelerating solar-market demand for hyperpure polysilicon (due to the large number of installations, mainly in Germany) and by a better-than-expected performance in the chemical industry.

Market sentiment about WACKER shares remained bullish in the second quarter, thanks to strong growth in the Group’s major target sectors – especially the solar industry. Although markets were nervous about the financial crises in Greece and Spain, WACKER’s stock climbed to €119.55 on June 30, 2010.

In the July-through-September quarter, the usual seasonal slowdown that affects WACKER’s chemical business in the summer did not materialize. Siltronic and WACKER POLYSILICON also posted high sales volumes. The Group’s sales and earnings reached new third-quarter records. The main growth drivers were construction and the solar sector, and Asian markets. Additionally, in late 2010, WACKER announced that continuing high demand for hyperpure polysilicon had enabled it to sell all its planned production output until 2013. The stock price reached €135.35 on September 30, 2010.

From October through December 2010, the Group’s share-price performance was mixed. At the start of the fourth quarter, there were concerns on financial markets that the economic recovery might weaken again. Even so, the share price climbed to a year-high of €149.65 on October 15, 2010. The solar industry’s continuing growth was one of the main factors here. Then, in early November, reports of a drop in demand for 300 mm silicon wafers put pressure on semiconductor shares – also influencing WACKER’s share price, which fell to €133.65 on November 19, 2010. On December 9, 2010, WACKER announced its decision to build a new polysilicon production facility in the USA with an annual capacity of 15,000 metric tons. The market responded positively to the news. Toward year-end, negative reports about a competitor and about the settlement of derivatives led to price declines – with WACKER stock closing at €130.60 on December 30, 2010.

Overall, WACKER stock gained eight percent in value during the year, but did not manage to emulate the performance of major German index averages. Over the same period, the MDAX was up 32 percent and the DAX up 14 percent. The WACKER stock’s high for the year was €149.65 and its low €87.47.