We supply products to a wide range of industries. Our main customers are in the semiconductor, solar, chemical, construction, energy and electronics sectors.

Semiconductor Market Recovers Strongly

In 2010, the semiconductor market experienced an upturn, driven primarily by higher sales volumes for computers and cellphones. As one of the world’s three largest silicon-wafer producers, WACKER’s Siltronic subsidiary benefited from this development and again posted positive EBITDA. Sales revenue and EBITDA were well above the previous year’s figures. SEMI, the international semiconductor industry association, reports sales-volume growth of 39 percent. Gartner, a market research institute, estimates demand for silicon wafers at about 62,700 million cm2 – a year-over-year increase of 39.6 percent. Demand for all wafer diameters rose, although there were differences among individual wafer sizes. Small and mid-sized wafers, in particular, saw substantial sales-volume growth. 300 mm wafers posted strong volume gains, too, though not quite as high as the smaller diameters. Prices presented a similar picture. Whereas prices for small and mid-sized diameters picked up, especially in the second half of the year, 300 mm prices remained below expectations. This was also reflected in Siltronic’s business trend.

| download table |

|

Installation of New PV Capacity in 2009 and 2010 |

|

|

| |||||||

|

|

Installation of |

CAGR1 | ||||||||

|

|

2010 |

2009 |

% | |||||||

| ||||||||||

|

|

|

|

| |||||||

|

Germany |

7,000 |

3,806 |

84 | |||||||

|

Italy |

1,500 |

711 |

111 | |||||||

|

Spain |

650 |

69 |

842 | |||||||

|

Other European countries |

2,365 |

1,019 |

132 | |||||||

|

USA |

1,000 |

477 |

110 | |||||||

|

Japan |

1,200 |

484 |

148 | |||||||

|

Asia |

900 |

190 |

374 | |||||||

|

Other regions |

900 |

447 |

101 | |||||||

|

Total |

15,515 |

7,203 |

115 | |||||||

Germany Is the World’s Key Photovoltaic Market

The photovoltaic market expanded dynamically in 2010. According to the EPIA (European Photovoltaic Industry Association), over 15.5 gigawatts (GW) of capacity were installed worldwide. The most important market for photovoltaic systems continued to be Germany, where almost 50 percent of annual capacity was installed. This growth was supported by timely permit and financing procedures and a strong distribution and installation network. German demand for photovoltaic systems was particularly high in the first half of the year, since feed-in tariffs were to be cut by 16 percent on July 1, 2010. As a cost and quality leader in the production of crystalline polysilicon (the key raw material for photovoltaic systems), WACKER once again benefited from this growth. Our entire output was sold on the market. Production capacity rose from 2009’s 18,100 metric tons to 30,500 metric tons in 2010. Strong demand for crystalline polysilicon meant that we could conclude new multiyear contracts involving advance payments with most of our customers and that spot-market prices were somewhat higher.

Soaring Chemical-Industry Growth in 2010

Global chemical production in 2010 almost regained its pre-crisis level. Production output, prices and sales increased sharply, especially in the first half of 2010. Momentum weakened in the second half of the year. Our chemical divisions’ performance in 2010 reflects the upturn. WACKER SILICONES, in particular, posted above-average growth and achieved a new sales record. Demand rose across every industry where we supply products. Germany’s Chemical Industry Association (VCI) estimates that the global chemical-pharmaceutical sector produced some 8.5 percent more than in 2009. Capacity utilization at German chemical companies was 85 percent, following 77 percent in 2009. Production grew 11 percent on the prior year. According to VCI estimates, sales rose by around 17.5 percent to €170.6 billion.

Construction Industry Still Weak in 2010

There was no recovery for the global construction industry in 2010. Based on data from Global Insight (a market research institute), sales actually were slightly below the prior-year level of US$5.4 trillion. The largest sector, residential construction, faced another slump, dropping 24.5 percent against 2009. Commercial properties saw a decline of 11.7 percent. In contrast, infrastructure projects edged up. Regionally, only Asia experienced higher construction spending. Construction activity fell yet again in the USA and Europe.

Source: Global Insight (September 2010)

WACKER POLYMERS’ business varied depending on the region. While the division posted a sales decline in the USA, it generated gains in almost all other countries – especially in India and China. Surprisingly, sales also increased in Western Europe, and above all in Germany. On the applications front, our tile-adhesive segment achieved positive growth, following the slump of 2009. WACKER profited even more from applications for energy-efficient and sustainable construction. Here, we increased sales volumes with products for thermal insulation systems and for the renovation of existing buildings.

WACKER SILICONES (which also supplies the construction sector) posted double-digit percentage growth rates in the fields of impregnation, insulation and masonry protection. Regionally, growth came primarily from Asia, in particular South Korea.

Electrical and Electronics Industries Resume Growth

With sales of €2.5 trillion, the global electrical and electronics industries returned to growth, following 2009’s revenue decline. The German Electrical and Electronic Manufacturers’ Association (ZVEI) estimates worldwide growth at 6 percent in 2010. Growth stemmed primarily from emerging economies (10 percent), while developed countries only posted an increase of 1 percent. The three WACKER divisions that serve the electrical and electronics sectors benefited from this uptrend. Siltronic reported a significant sales gain compared to 2009. WACKER POLYSILICON sold 15 percent of its 2010 polysilicon capacities to the electronics industry.

WACKER SILICONES, which sells its products to diverse industries, also increased its sales. The automotive-electronics market alone grew 18 percent year over year to US$147 billion. WACKER SILICONES boosted its automotive-electronics sales by over 50 percent compared to 2009. The division also generated growth rates of over 35 percent with its silicone resins for low-voltage applications and with its silicone elastomers for medium-voltage and high-voltage insulators.

Overall Statement on Underlying Conditions

The global economy recovered more quickly and dynamically than expected. There was a substantial growth spurt, primarily in the first half of 2010, which lost momentum in the second half. All WACKER divisions profited from this growth. Siltronic – which had been particularly impacted by the semiconductor crisis – achieved especially strong gains, as did both WACKER POLYSILICON and WACKER SILICONES. WACKER POLYSILICON forged ahead, with growth supported by significantly higher production output. In addition, strong demand, led to a slight price increase for crystalline polysilicon. WACKER SILICONES benefited from a surge in incoming orders across all industries and products, and set new sales and EBITDA records. WACKER POLYMERS increased its sales and EBITDA, too. However, the combination of higher raw-material prices and stable selling prices for dispersions and dispersible polymer powders held back EBITDA.

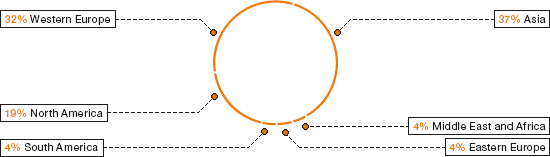

In 2010, WACKER increased its revenues by double-digit rates in every sales region. Growth was strongest in Asia, particularly China. Asia’s share of total Group sales continued to rise and is currently at 36 percent. See further details on Regions