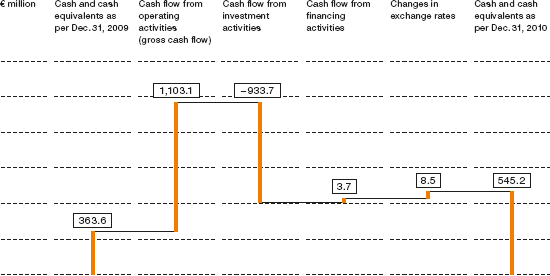

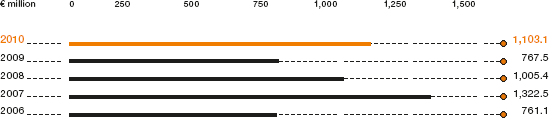

In 2010, WACKER funded its investments entirely out of its own cash flow. At €1.10 billion, gross cash inflow from operating activities (gross cash flow) was up 44 percent (2009: €767.5 million). This was mainly due to our high net income of €497.0 million (2009: €-74.5 million) and the marked rise in advance payments received from customers for future polysilicon shipments. Cash inflows from advance payments were €165.2 million (2009: €36.9 million).

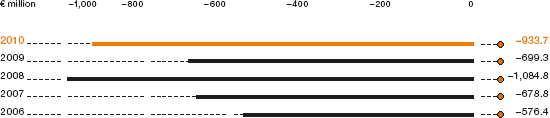

The cash flow from noncurrent investment activities shows that we continue to invest sizable amounts in the ongoing expansion of our production facilities. In 2010, capital expenditures of €617.3 million mainly focused on buildings, plants and machinery, and infrastructure. The majority of spending was for production-capacity expansion at WACKER POLYSILICON and for additional silicone production facilities in China at WACKER SILICONES. We enhanced supply security for silicon metal (our key raw material) by acquiring the Holla-based silicon-metal plant in Norway. To strengthen business in Asia, WACKER acquired the Lucky-Silicone brand and the associated production plant in South Korea. In total, these two acquisitions led to cash outflow of €81.2 million. WACKER received proceeds of €25.4 million from the sale of its 50-percent share in US-based Planar Solutions LLC to FUJIFILM Electronic Materials.

In 2010, WACKER purchased current and noncurrent securities totaling €252.2 million that are allocable to cash flow from investment activities. A year earlier, securities of €101.1 million had been sold.

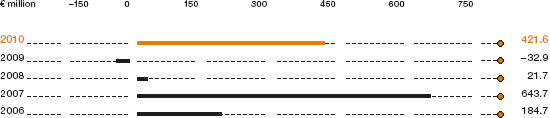

Net cash flow (the difference between cash inflow from operating activities and cash outflow due to long-term investment activities before securities) amounted to €421.6 million (2009: €-32.9 million), a gain of €454.5 million compared to the prior year.

In 2010, cash inflow from financing activities was €3.7 million (2009: €92.5 million). The dividend payment for 2009 reduced cash flow from financing activities by €59.6 million. In contrast, entering into bank liabilities generated, on balance, a cash inflow of €73.2 million.

Cash and cash equivalents resulting from cash flow and adjusted for exchange-rate fluctuations went up by €181.6 million to €545.2 million as of year-end 2010.