The WACKER Group closed 2012 with lower sales and, as expected, a marked decline in EBITDA. This sales and earnings decrease mainly stemmed from the difficult situation on the photovoltaic market, which is currently facing overcapacity, high inventory levels and ongoing consolidation pressures, with numerous solar customers experiencing financial problems. At Siltronic, lagging demand for silicon wafers and lower prices reduced sales and earnings. Conversely, the three chemical divisions performed positively in 2012, but could not offset the sales and EBITDA declines posted by the other two business divisions. The Group’s net income for the year amounted to €106.8 million, down €249.3 million on the previous year (2011: €356.1 million).

Sales Decrease 6 Percent to €4.63 Billion

In 2012, WACKER generated total sales of €4.63 billion, 5.6 percent lower than a year earlier (2011: €4.91 billion). The decline was due to WACKER POLYSILICON and Siltronic. Although WACKER POLYSILICON sold greater volumes of polysilicon than the previous year, sales decreased by 22 percent to €1.14 billion (2011: €1.45 billion). The division’s sales trend reflected the significantly reduced market prices and high inventories in the photovoltaic supply chain. At Siltronic, sales also decreased primarily due to the impact of lower prices on volumes. Sales fell 12.5 percent to €867.9 million (2011: €992.1 million). WACKER POLYMERS recorded the biggest sales increase. Surging 8.1 percent, its sales surpassed the billion-euro mark for the first time ever (2011: €928.1 million). This was mainly due to the construction industry’s recovery and the division’s robust performance in the carpet and packaging sectors, where WACKER’s VAE dispersions are increasingly replacing styrene-butadiene and styrene-acrylate. All regions saw sales rise. WACKER SILICONES also reported sales growth. Stronger volumes pushed its sales up by 3.4 percent to €1.65 billion (2011: €1.59 billion). Price pressures, especially on standard products, though, dampened the division’s sales performance. WACKER BIOSOLUTIONS increased its sales by 9.1 percent to €157.6 million (2011: €144.5 million). This rise was due to higher volumes.

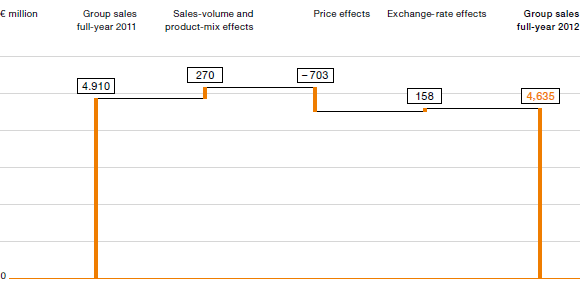

Year-on-Year Sales Comparison

Volume growth increased sales by €270 million and exchange-rate effects by €158 million. A key contributor here was the dollar-euro exchange rate. The average rate in 2012 was 1.29 dollars to the euro (2011: 1.39). Lower prices in particular decreased Group sales by €703 million.

WACKER generated the largest share of its sales outside Germany. During 2012, international sales reached €3.95 billion (2011: €4.01 billion), accounting for 85 percent of total Group sales. WACKER’s biggest market by far is Asia, where growth is mainly driven by strong customer demand for the Group’s silicones and polymers. Asia is also WACKER’s primary polysilicon market.

| Download XLS |

|

Domestic and International Sales (by Customer Headquarters) | ||||||||||||||

|

|

|

|

|

|

|

|

| |||||||

|

€ million |

2012 |

2011 |

2010 |

2009 |

2008 |

2007 |

2006 | |||||||

|

|

|

|

|

|

|

|

| |||||||

|

External sales |

4,634.9 |

4,909.7 |

4,748.4 |

3,719.3 |

4,298.1 |

3,781.3 |

3,336.9 | |||||||

|

Of which Germany |

686.0 |

899.4 |

887.3 |

774.6 |

948.6 |

723.5 |

657.6 | |||||||

|

Of which International |

3,948.9 |

4,010.3 |

3,861.1 |

2,944.7 |

3,349.5 |

3,057.8 |

2,679.3 | |||||||

EBITDA down 29 Percent Year over Year

Earnings before interest, taxes, depreciation and amortization (EBITDA) amounted to €786.8 million in 2012, down 28.7 percent from a year earlier (2011: €1.10 billion). The EBITDA margin was 17.0 percent (2011: 22.5 percent). The EBITDA decline stemmed primarily from the lower prices for polysilicon. At WACKER POLYSILICON, the EBITDA margin dropped from the prior-year’s 51.6 percent to 37.6 percent. The division had income of €113.1 million (2011: €66.2 million) from the retention of advance payments and from damages relating to the termination of contracts.

In 2012, WACKER adjusted the financing of its associated company with Dow Corning. The new terms reduce the transfer prices paid for siloxane procured from Dow Corning. This has allowed WACKER to reverse the €79.6 million provision for contingent losses from purchase obligations under contracts with the associated company. On the assets side, the carrying amount of WACKER’s 25-percent interest in this associated company, which is accounted for using the equity method, was reduced by €77.0 million.

EBIT for the year amounted to €258.0 million, down 57.2 percent (2011: €603.2 million). Depreciation and amortization rose 15 percent to €526.3 million (2011: €459.6 million). In response to the altered market situation, WACKER shortened the useful life of polysilicon-plant infrastructure and technical facilities from 2012 forward, which had an effect on the depreciation recognized. Depreciation was also increased by the start-up of the new Poly 9 expansion stage at Nünchritz. The EBIT margin for 2012 was 5.6 percent (2011: 12.3 percent). Both EBIT and EBITDA were affected by the non-recurring effects shown in the table.

| Download XLS |

|

Non-Recurring Effects in 2012 | ||

|

|

| |

|

€ million |

2012 | |

|

|

| |

|

Advance payments retained and damages received |

113.1 | |

|

Obligations relating to the closure of the 150 mm line in Portland |

-14.8 | |

|

Total non-recurring effects on EBITDA |

98.3 | |

|

Total non-recurring effects on EBIT |

98.3 | |

| Download XLS |

|

Non-Recurring Effects in 2011 | ||

|

|

| |

|

€ million |

2011 | |

|

|

| |

|

Advance payments retained and damages received |

66.2 | |

|

Life-expectancy adjustments to provisions for pensions |

-29.9 | |

|

Obligations relating to the closure of the Hikari site |

-49.6 | |

|

Total non-recurring effects on EBITDA |

-13.3 | |

|

Impairments on noncurrent assets (Hikari, granular polysilicon plant) |

-38.4 | |

|

Total non-recurring effects on EBIT |

-51.7 | |

Lower Revenues Weighing on Gross Profit from Sales

Gross profit from sales fell by €349.4 million to €813.1 million (2011: €1.16 billion), down 30 percent from a year earlier. The cost of sales edged higher year over year, up 2 percent to €3.82 billion. Diminished sales reduced the gross margin from 24 percent a year earlier to just under 18 percent in 2012. Specific production costs, which are governed primarily by energy and raw-material costs, did not rise overall compared with the previous year. Increased depreciation, at €66.7 million, resulted, among other things, from the shortened useful lives of polysilicon plants and from the start-up of the Poly 9 expansion stage at Nünchritz. Depreciation and amortization for full-year 2012 totaled €528.8 million (2011: €501.0 million). The prior-year figure included €41.4 million in impairment losses on property, plant and equipment. In Q3 and Q4 2012, WACKER POLYSILICON aligned plant utilization with the lower volumes demanded by customers. This resulted in higher fixed costs per kilogram of polysilicon. The provision of €79.6 million for contingent losses from purchase obligations under contracts with the Dow Corning associated company was reversed. The cost-of-sales ratio for the year stood at 82 percent (2011: 76 percent).

Functional Costs Reduced

Other functional costs (selling, R&D and general administrative expenses) decreased by €3.8 million year over year to €573.9 million in 2012 (2011: €577.7 million).

Other Operating Income and Expenses

In 2012, the balance of other operating income and expenses was €101.3 million (2011: €26.1 million). The positive balance is mostly attributable to income from the retention of advance payments and from damages relating to the termination of individual polysilicon contracts, which added €113.1 million to earnings. Other operating expenses include not only project-specific start-up costs for the polysilicon facilities in Tennessee, but also costs for the shutdown of the 150 mm wafer line at Portland. Other operating income and expenses additionally include a net foreign currency loss of €7.9 million, which contrasts with the positive balance of exchange-rate gains and losses of €39.8 million reported a year earlier.

Operating Result

Due to the effects stated above, the operating result fell from €610.9 million in 2011 to €340.5 million – a drop of 44 percent.

Result from Investments in Joint Ventures and Associates

The investment result – the total income from investments in joint ventures and associates and other income from participations – amounted to €-82.5 million (2011: €-7.7 million) and was shaped by two specific circumstances. WACKER recorded a net loss of €5.6 million on its current equity investments and expenses. The joint venture with Samsung for the production of 300 mm wafers recorded investment losses in 2012, due to high levels of depreciation. As a consequence of the renegotiation of the transfer prices for siloxane with Dow Corning, we have adjusted the carrying amount of our 25-percent interest in the Singapore-based associated company Dow Corning (ZJG) Holding Co. Private Ltd. The new lower transfer prices will reduce the associated company’s future cash inflows substantially. The related impairment test resulted in a charge of €77.0 million.

Financial and Interest Result

The WACKER Group’s financial result was €-64.8 million (2011: €-35.8 million). The interest result was also negative at €-10.2 million, which was €13.6 million lower than in 2011 (€+3.4 million). The high levels of liquidity and securities held previously were partially reduced during the second half of 2012 in order to fund our investment projects. WACKER generated interest income of €16.0 million from its investments in securities and money market instruments (2011: €16.9 million). Conversely, the loans we raised for capital expenditures increased interest expenses to €26.2 million (2011: €13.5 million). Construction-related borrowing costs capitalized in the year under review and amounting to €14.2 million (2011: €11.3 million) had a positive effect. The other financial result was €-54.6 million (2011: €-39.2 million). This amount primarily contains expenses recognized for the unwinding of discounted pension and other provisions and of financial-investment hedging.

Income taxes

The Group reported tax expenses of €86.4 million, down 59 percent from the previous year (2011: €211.3 million). The Group’s tax rate for 2012 was therefore 44.7 percent (2011: 37.2 percent). Adjusted for expenses and losses at a number of Group companies that are not tax-deductible, the tax rate was approximately 30 percent. The tax expenses reported consist mainly of the Group’s current income taxes.

Net Income

The Group’s net income for 2012 amounted to €106.8 million (2011: €356.1 million).

| Download XLS |

|

Combined Statement of Income | ||||||

|

|

|

|

| |||

|

€ million |

2012 |

2011 |

Change in % | |||

|

|

|

|

| |||

|

Sales |

4,634.9 |

4,909.7 |

-5.6 | |||

|

Gross profit from sales |

813.1 |

1,162.5 |

-30.1 | |||

|

Selling, R&D and general administrative expenses |

-573.9 |

-577.7 |

-0.7 | |||

|

Other operating income and expenses |

101.3 |

26.1 |

>100 | |||

|

Operating result |

340.5 |

610.9 |

-44.3 | |||

|

Result from investments in joint ventures and associates |

-82.5 |

-7.7 |

>100 | |||

|

EBIT |

258.0 |

603.2 |

-57.2 | |||

|

Financial result |

-64.8 |

-35.8 |

81.0 | |||

|

Income before taxes |

193.2 |

567.4 |

-65.9 | |||

|

Income Taxes |

-86.4 |

-211.3 |

-59.1 | |||

|

Net income for the year |

106.8 |

356.1 |

-70.0 | |||

|

Of which attributable to Wacker Chemie AG shareholders |

112.8 |

352.6 |

-68.0 | |||

|

Of which attributable to non-controlling interests |

-6.0 |

3.5 |

n.a. | |||

|

Earnings per share (basic/diluted) (€) |

2.27 |

7.10 |

-68.0 | |||

|

|

|

|

| |||

|

Average number of shares outstanding (weighted) |

49,677,983 |

49,677,983 |

– | |||

|

|

|

|

| |||

|

Reconciliation to EBITDA |

|

|

| |||

|

EBIT |

258.0 |

603.2 |

-57.2 | |||

|

Depreciation/appreciation of noncurrent assets |

528.8 |

501.0 |

5.5 | |||

|

EBITDA |

786.8 |

1,104.2 |

-28.7 | |||

|

ROCE (%) |

5.2 |

13.9 |

-62.6 | |||