Sales and Marketing

Sales of WACKER Products Decline Slightly

Our products’ overall sales were slightly lower in 2013. Revenues at WACKER POLYSILICON and Siltronic remained below the previous year, mainly due to pricing policies. Sales at the three chemicals divisions – WACKER POLYMERS, WACKER SILICONES and WACKER BIOSOLUTIONS – matched the prior-year level.

Our business is characterized by high repeat-purchase rates. 99 percent of Siltronic’s 2013 product sales were transacted with customers we had supplied in 2012. At WACKER POLYMERS, the repeat-purchase rate was 95 percent (by revenue), and the rate at WACKER SILICONES was over 92 percent. The repeat-purchase rate at WACKER POLYSILICON is not meaningful, since there are customers who have completely withdrawn from the solar business.

Having introduced “SMART” (a new customer management system) for our three chemical divisions in 2011, we extended its coverage to WACKER POLYSILICON in 2012. This highly integrated system allows customer data to be recorded and documented, as well as combined with customer-related data from all SAP modules.

WACKER customers break down into three groups: global key accounts, customers, and distributors. Key accounts are customers of special strategic significance for WACKER and with high sales levels. WACKER currently has 37 key accounts with whom we generated around 25 percent of our 2013 revenue in the chemical divisions (WACKER SILICONES, WACKER POLYMERS, WACKER BIOSOLUTIONS). Over 55 percent of our chemical-related revenue was from our approximately 8,000 other active customer relationships and around 20 percent from distributors.

The share of sales transacted through electronic sales platforms increased further in 2013. Such platforms are in place in 63 countries. E-business is used most frequently in Asia, where it accounts for around 45 percent of sales at the chemical divisions.

Sales and Distribution Network Optimized

We are working with new distribution partners in Poland, the UK and Ireland. China and India are now served by new distributors. We have increased our business with the major international partners Brenntag, DKSH and IMCD. Despite these developments, distributor numbers have not changed from a year earlier. We collaborate with 280 distributors (2012: 280) and five distributor groups. The number of countries in which WACKER sells its products has risen to 95 (2012: 87). Around 80 percent of business with distributors is transacted with just over 50 partners.

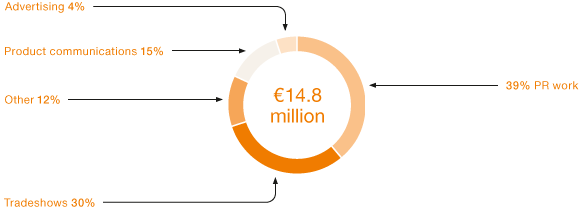

Marketing communication is a key element for strengthening WACKER’s branding and for supporting product sales effectively. In 2013, we spent € 14.8 million (2012: € 13.8 million) on marketing communication.

Percentage of Marketing Costs

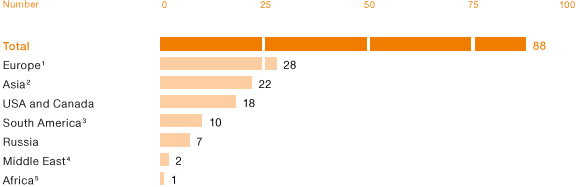

Attendance at 88 Tradeshows Worldwide

WACKER increased its tradeshow presence in 2013, having a booth at a total of 88 tradeshows (2012: 80). For the first time ever, we presented our polymer and silicone products for construction applications at a show in Africa. WACKER demonstrated water-repellent dispersion powders and silicone sealants at the BUILDEXPO in Nairobi. The calendar for 2013 featured two major events, the plastics show K in Düsseldorf and the coatings show ESC in Nuremberg. We presented 11 new products at the K, and 10 at the ESC. We analyze the success of our tradeshow communications qualitatively and quantitatively, with 24 shows reviewed in 2013 (2012: 23).

Tradeshows in 2013

1 Austria, Belgium, Czech Republic, Denmark, France, Germany, Switzerland, Turkey, UK

2 China, India, Japan, Thailand

3 Argentina, Brazil, Chile

4 Dubai

5 Kenya