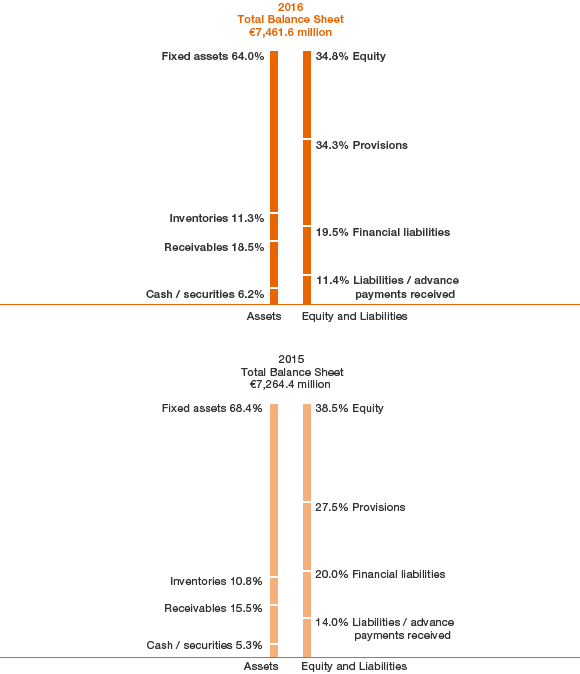

Net Assets

WACKER’s total assets increased by close to 3 percent compared with December 31, 2015. Rising by €196.2 million, they amounted to €7.46 billion as of December 31, 2016 (Dec. 31, 2015: €7.26 billion). Essentially, both trade receivables and inventories grew. Lower capital spending and good operating cash flow lifted liquid assets significantly. On the other side of the balance sheet, provisions for pensions rose 30 percent as discount rates continued their downward trend. Advance payments received declined substantially. This was because the agreed polysilicon volumes corresponding to these payments were delivered to customers and other customer contracts were terminated. Group equity fell 7 percent, reflecting primarily the increases in provisions for pensions, which are recognized in other comprehensive income. A year earlier, the proceeds received from third-party investors in the successful IPO of Siltronic AG had increased Group equity by €361.9 million.

Asset and Capital Structure