Outlook for 2016

WACKER’s main planning assumptions relate to raw-material and energy costs, personnel expenses and exchange rates. For 2016, we are planning on an exchange rate of US$ 1.10 and ¥ 135 to € 1.

Performance Indicators and Value-Based Management

WACKER’s key financial performance indicators are unchanged compared with the previous year.

Volume Growth to Support Group Sales in 2016

WACKER anticipates volume growth at every division in 2016. Our planning assumes that prices for silicon wafers will decline slightly. On average, prices for polysilicon will be below the prior-year level. With the start of production in Tennessee, additional quantities will not be sold exclusively through long-term contracts. Group sales are expected to climb by a low single-digit percentage amid low prices for polysilicon.

Economic uncertainties could cause the actual performance of the WACKER Group and its divisions to diverge from our assumptions, either positively or negatively.

From today’s perspective, each division will increase its sales, except for Siltronic. We expect Asia to deliver the biggest sales gains for our products. In 2017, sales should advance further compared with 2016 – provided that the world economy remains on its growth path, as economic research institutes predict, and that there are no unforeseeable slumps in WACKER’s key regions and industries.

Outlook for 2016

|

||||||

|

Reported for 2015 |

Outlook for 2016 |

||||

|

|

|

||||

|

||||||

Key Financial Performance Indicators |

|

|

||||

EBITDA margin (%) |

19.8 |

Somewhat lower |

||||

EBITDA (€ million) |

1,048.8 |

Slight increase when adjusted for special income1 |

||||

ROCE (%) |

8.1 |

Substantially lower |

||||

|

|

|

||||

Net cash flow (€ million) |

22.5 |

Markedly more positive |

||||

|

|

|

||||

Supplementary Financial Performance Indicators |

|

|

||||

Sales (€ million) |

5,296.2 |

Slight increase |

||||

Capital expenditures (€ million) |

834.0 |

Around € 425 million |

||||

Net financial debt (€ million) |

1,074.0 |

On a par with the prior-year level |

||||

|

|

|

||||

Depreciation (€ million) |

575.7 |

Around € 720 million |

||||

Outlook for the Key Performance Indicators at the Group Level

From today’s perspective, the key performance indicators at the Group level will develop as follows.

EBITDA margin and EBITDA: the EBITDA margin will come in somewhat below the prior-year figure. This is because we do not anticipate a comparably high level of solar-sector special income from damages received and from terminated contractual and delivery relationships with customers. Another factor weighing on our EBITDA margin will be the generally lower price level in our business. Relative to last year, EBITDA – adjusted to exclude solar-sector special income from damages received and from terminated contractual and delivery relationships with customers – should rise slightly. With depreciation higher year over year, and assuming an effective tax rate of 40 percent, Group net income will come in significantly below the 2015 figure.

ROCE: compared with the prior year, ROCE will be substantially lower (2015: 8.1 percent) due to higher depreciation and an increase in capital employed.

Net cash flow: with capital expenditures substantially lower, we expect net cash flow in 2016 to be markedly more positive than in the prior year.

Outlook for Supplementary Performance Indicators at the Group Level

Capital expenditures: amounting to about € 425 million, investments will decline significantly in 2016 and be well below the level of depreciation. Depreciation will reach around € 720 million in 2016, significantly higher than the year before. Capital-expenditure projects will include capacity expansions for intermediate and downstream products at our chemical divisions and new pulling facilities for manufacturing monocrystals at Siltronic. The anticipated cash flow from operating activities is likely to fully cover investment spending.

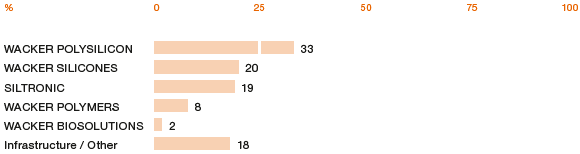

Investments by Division in 2016

Net financial debt: net financial debt will be on a par with the prior-year level (2015: € 1,074.0 million).

Divisional Sales and EBITDA Trends

At WACKER SILICONES, we expect to achieve a mid-single-digit increase in sales in 2016 relative to the previous year. Sales growth will be fueled by every WACKER SILICONES business sector. The strongest momentum will continue to come from Asia, where rising affluence is prompting higher consumption of silicone products. We continue to anticipate robust growth in India. We also expect sales to increase in the Americas and Europe. Particular growth areas are products and applications for personal care, plastics, medical technology, the electrical and electronics sectors, and silane-modified polymers. Further, we want to increase the share of specialty products in overall sales and keep capacity utilization high. EBITDA should climb substantially year over year.

At WACKER POLYMERS, our forecast is for a mid-single-digit increase in sales compared with the previous year. Both dispersions and dispersible polymer powders will contribute to this growth. In dispersions, we anticipate gains in coatings applications and nonwovens for personal hygiene articles. In dispersible polymer powders, the main impetus comes from increasing polymer modification. We want to lift sales in all three regions – Europe, the Americas and Asia – in 2016. We continue to see strong growth potential in India, where we intend to achieve a further significant increase in sales. As for EBITDA, we anticipate a slight year-over-year increase.

At WACKER BIOSOLUTIONS, our projection is for a mid-single-digit increase in sales in 2016. In particular, we see further growth prospects for pharmaceutical proteins. In the nutrition sector, WACKER BIOSOLUTIONS will launch a new technology for the chewing-gum and confectionery industries. In regional terms, we expect to see the greatest growth opportunities in Europe. EBITDA should come in at the prior-year level.

As regards our polysilicon operations, we expect to post further volume growth in 2016 thanks to our new production site in Charleston, Tennessee (USA). The photovoltaic market will continue expanding. In spite of volume growth, we expect WACKER POLYSILICON’s sales to grow only slightly as we anticipate prices to be lower on average than in the previous year. Our EBITDA forecast is for a marked year-over-year decline, since we expect less special income in 2016 in the form of advance payments retained and damages received from our customers. Despite being lower than in the prior year, the costs of further ramp-up of polysilicon production at the new Charleston site will diminish EBITDA.

At Siltronic, we anticipate a slight 2016 sales decrease due to lower market prices. We expect to see further volume growth in our 300 mm business. Cost-optimization measures and lower currency-hedging expenses will have a positive influence on EBITDA, which we expect to increase substantially compared with the prior year.

Future Dividends

WACKER’s policy on dividends is generally oriented toward distributing at least 25 percent of Group net income to shareholders, assuming the business situation allows this and the committees responsible agree.

Financing

The main aspects of our financing policy remain valid. We are confident that we have a strong financial profile with a sensible capital structure and healthy maturities for our debt. As of December 31, 2015, WACKER had at its disposal unused lines of credit with residual maturities of over one year totaling some € 600 million.

Medium-Term Goals

The medium-term goals through 2017 remain in place. Our focus is on increasing the Group’s profitability and generating a positive cash flow.

Executive Board Statement on Overall Business Expectations

The economic and political risks for 2016 have increased in recent months. In particular, the slowdown of China’s economy and the steep decline in oil prices have clouded the outlook for global growth. WACKER expects the world economy to expand further despite these difficult underlying conditions. From today’s perspective, growth will continue in 2017. We anticipate a slight rise in Group sales in 2016, with each division lifting its sales, except for Siltronic. We forecast a slight rise in EBITDA, when adjusted to exclude special income. The EBITDA margin, on the other hand, will be somewhat lower, since we do not expect any major special-income items. Additionally, there are the commissioning costs for our new production site in Charleston, Tennessee (USA). Total energy and raw-material costs will decrease compared with the previous year.

At about € 425 million, capital expenditures will be substantially lower year over year, while depreciation will be significantly higher at around € 720 million. Projections for net cash flow are markedly positive. Net financial debt will be on a par with the prior-year level. Group net income is likely to be substantially lower than the year before.

Our four biggest divisions hold at least a No. 3 position in their respective markets, and we supply outstanding products. Our technological and innovative strength and our presence in key markets offer us a firm basis for reinforcing and expanding our market positions.

We see good opportunities in 2016 for further sales gains and for moderate growth in EBITDA, adjusted to exclude special income. Given our current strategy, we are well positioned to continue growing profitably beyond 2016.

As of the date on which these financial statements were prepared, no changes had been made to our forecast.